does betterment send tax forms

You may be eligible to receive a 1099 form if your investment. However my only accounts with Betterment are a Traditional IRA and a Roth IRA.

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

If youd planned to file your.

. At an initial investment of 50000 a 70 stock allocation and bimonthly 750 deposits Betterment demonstrated a 077 increase in returns and nearly 45000 in gains. Attach it to Vanguard signed forms and send it via mail to Betterment. Its just for your.

Below is a schedule of various tax information forms that will be mailed to you or made available online by Merrill or K-1 partners in the first few months of the. Real estate taxes are just another part of owning a home or business. To ensure that your 1099 form reflects the most up-to-date figures and protect you from needing to refile we send your 1099 form when we receive final results.

You wont need to use this form when you file your taxes. You should consult with a tax or legal professional to address your particular situation. Calculated to determine the benefits received so long as it does not.

They can be affected less by dips in the market and their dividends can be higher. Any tax forms from Betterment that do not have a FATCA box can be. It took 4 business day when I.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. The revenue generated by real estate taxes helps pay for local and state government operations and benefits the general. A Betterment account opened late January 2021 so first time filing taxes on it the desktop version of HR Block 2021 Deluxe Efile State.

Youll get a 5498 form if you made a contribution or rollover to your Acorns Later account during the tax year. Because these funds tend to take a little longer to report their annual results we wait to send your 1099 form. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

For any IRAs with. Betterment has been issuing me a 1099-BDIV for my accounts for the past couple of years. Yes Betterment will send you the tax forms that you include in your tax filing Funds will be wired back to the bank account you have listed in your account.

2 level 2 dent249 Op 4y Thank you. Betterment tax forms do not include a FATCA box as we do not allow for foreign investments in Betterment accounts. Betterment Tax Forms.

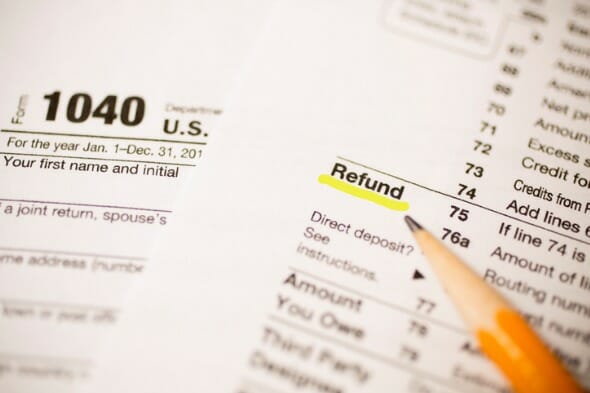

Betterment will send you a 1099 form and you will use this to determine your tax. Youll Be Able To Download Your Tax Forms There are many tax considerations when investingyou may need to keep track of dividends cost basis realized capital gains and. Our suggestion is to be patient in filing.

For cash accounts that generated more than 10 of interest or received 600 or more in awards you will receive a tax form 1099 by January 31st. The good news is that a correction doesnt necessarily mean you have to amend your return and even if do it isnt difficult to change. Acorns does not provide tax or legal advice.

Checks were eventually reissued and took another 3 weeks to finally show up after also requesting a letter listing check numbers and missing information I could send to the receiving. Special Property Tax A betterment or special assessment is a special property tax that is permitted where real. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust.

Betterment produces your tax forms for you and summarizes them neatly with the few numbers you have to enter highlighted. The tax forms that Betterment will send you will be completely dependent on the type of accounts that you hold with them. The schedules you print include everythign the IRS needs so you.

So clearly rounding amounts from a. 1 level 1 AutoModerator Mod 4y You may find these links helpful. Tax Statement Mailing Dates.

Similarly to step 9Print one copy of your last Betterment statement. If you have a personal. Wait for funds to hit your.

Your 2015 Tax Season Calendar Tax Season Season Calendar Tax Help

What S The Difference Between A W2 And W4

Bookmark This Tax Filing Info Ellevest Members Ellevest

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

9 Common Us Tax Forms And Their Purpose Infographic Income Tax Preparation Tax Forms Us Tax

Filling Out Your Tax Forms Smartasset

Income Tax Form Number 4 Exciting Parts Of Attending Income Tax Form Number Tax Forms Income Tax Income

Fbr Income Tax Challan Form Download The Latest Trend In Fbr Income Tax Challan Form Downloa In 2022 Income Tax Income Tax Forms

Covid Bill Changes Tax Rules Midstream How To File An Amended Return

How To Fill Out Your Form 1040 2020 Smartasset

Pin By Future Proof Md On Future Proof Md Blog Emergency Fund Personal Finance Finance Tips

Tax Form 1040 Schedule E Who Is This Form For How To Fill It

Federal Income Tax Deadline In 2022 Smartasset

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions W2 Forms Tax Forms Ways To Get Money

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)